See what you know about the stock market.This is a quiz about Wall Street knowledge. Do you think you can handle it?

What was the name of the historic contract that 24 stockbrokers outside of 68 Wall Street signed on May 17, 1792, ostensibly creating the NYSE?

Buttonwood Agreement

The so-called Buttonwood Agreement gained its name from a meeting of twenty of New York City’s most significant merchants that took place under a buttonwood tree in 1792 to discuss methods to formalize and stabilize the security trading industry. A year later, the NYSE arrived while they were having their meeting at the Tontine Coffee House at the intersection of Wall and Water streets.

What is the word for the practice of buying and selling the same asset concurrently in various marketplaces to benefit from the negligible variation in the stated price?

Arbitrage

According to Investopedia.com, arbitrageurs also serve a helpful purpose by acting as middlemen, supplying liquidity in various markets. Arbitrage trading is not only permitted but actively encouraged in the United States since it improves market efficiency.

In the Wikipedia entry for “Wall Street,” it’s described as a street in the Financial District of Manhattan how many blocks long?

8

Wall Street is a real street in lower Manhattan that spans 8 blocks from Broadway on the west side to South Street (the location of the renowned seaport), straight along the East River, despite being linked with the stock market that trades there. When the Dutch-owned Manhattan, the street was referred to as “de Waalstraat.”

What is known as “Triple” expiry, which only happens four times a year, occurs when contracts for stock options, stock index futures, and stock index options all expire on the same day.

Witching

The third Friday in March, June, September, and December is known as “Triple Witching,” which can result in unusual volatility in stock prices and erratic trading.

What is the phrase used on Wall Street when a stock price surges higher, prompting traders who had bet that it would decline to buy more shares and sounding a lot like a sports term?

Short squeeze

A short squeeze, according to Wikipedia, “occurs when there is a dearth of supply and an excess demand for the stock due to short sellers having to acquire stocks to cover their short positions,” which causes the price of the stock to spike quickly.

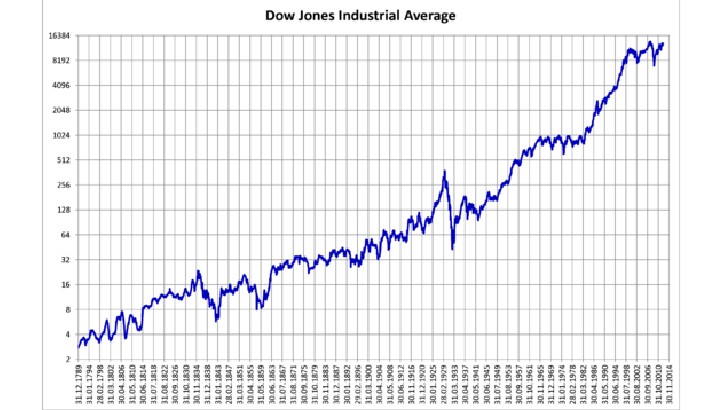

What number of firms’ values are represented by one of the most important indexes on the American stock market, the Dow Jones Industrial Average, or DJIA?

30

The DJIA was created on May 26, 1896, and it gauges the stock performance of 30 major firms traded on the exchange. The DJIA is calculated by summing the stock prices of the businesses included in the index and dividing that result by a certain variable factor, which is often around.15. It is second only to the Dow Jones Transportation Average in terms of importance.

The Dow Jones Industrial Average reached 33,000 in 2021. What was the Dow’s value on September 3, 1929, the day before it reached its high before collapsing in October of that same year?

381

Less than two months before its fall in October 1929, the DJIA reached a high of 381 or roughly 1% of its value in 2021. The Dow fell 40% from its peak on October 29 of that year, closing at just 230.07. The economic crisis in the United States and others lasted for many years after that.

What role does Muriel Siebert’s name play in the history of the New York Stock Exchange?

First female CEO of a Dow Jones company

The first woman to become a stock broker

The first woman to buy a seat on the exchange

She redesigned the building at 23 Wall Street

The first woman to buy a seat on the exchange

When it comes to women’s positions in the financial sector, Muriel Siebert was a pioneer. She was able to gather $445,000 in the late 1960s, which was enough to get a seat on the New York Stock Exchange in 1967. She founded her own business two years later, becoming one of just two women among 1,365 males to trade on the stock exchange until 1977.

What Wall Street park served as the focal point of the Occupy Wall Street movement before they were forcibly removed on November 15, 2011?

Zuccotti Park

In 2011, Occupy Wall Street’s occupation of Zuccotti Park dominated the news as protesters established camps there to call attention to the banks responsible for the 2007–2008 financial crisis. The movement spread after they were driven from Zuccotti, but it persisted for several more years.

Even though stock trading is often associated with New York City, where did the first stock market begin in 1790?

Philadelphia

In 1970, the Board of Brokers of Philadelphia, the first stock market in the United States, opened its doors. After merging with the Baltimore Stock Exchange, it was briefly known as the Philadelphia-Baltimore Stock Exchange before becoming the NASDAQ OMX PHLX.

What was the commodity at the center of Wall Street’s first bubble, which burst as Wall Street was being developed, according to the 2011 Business Insider article “How Well Do You Know Wall Street?”?

Tulips

By 1637, Dutch tulip traders were making incredible profits selling tulips; sums that would equal about $60,000 a month in today’s money. It all came crashing down when one trader in Holland was unable to pay his debt. The so-called “Tulipomania” occurred at the same time that the Dutch were settling in New York and constructing what would become Wall Street.

Out of our 46 U.S. Presidents were sworn in on Wall Street; you might say that “money” was the theme of his swearing-in. Whose installation as commander in chief was it?

George Washington

Washington was sworn in on the second-floor balcony of Federal Hall, which is located on Wall Street, under the direction of Robert R. Livingston, who was the Chancellor of New York at the time. The location is significant historically since it was the first City Hall in New York and the location where the Stamp Act Congress met to draft their letter to King George III.

The Wall Street opening bell has a lengthy history; it was initially used in the 1970s. What was the preferred bell until a brass bell was introduced in 1903?

Chinese gong

A Chinese gong inaugurated the NYSE until it relocated to its current structure, at which point a brass bell that was electrified and large enough to resound throughout the expansive trading floor took its place. Today, each of the four trade areas has its bell, which is controlled by a single control panel.

The very first business was listed on the NYSE in 1792. What sector was that first publicly listed firm from?

Banking

Bank of New York, which Hamilton had created eight years previously, was the first business to go public on the brand-new NYSE. Bank of New York later changed its name to BNY Mellon and is currently traded under the ticker BK. Before the bank was listed, the NYSE dealt predominantly with war bonds and was primarily a government securities market.

Which of the following corporations recorded the highest price per share for a publicly listed company in 2020, shattering all kinds of Wall Street records?

Berkshire Hathaway

Bank of New York, which Hamilton had created eight years previously, became the first corporation to be publicly listed on the recently established NYSE. Later, the Bank of New York changed its name to BNY Mellon and began trading under the ticker BK. NYSE used to be primarily a government securities exchange where War Bonds were exchanged before the bank was listed.

The saying “Greed is Good” is taken from the classic film Wall Street. Which of the following descriptions of the movie is FALSE?

Has the first use of a cordless mobile phone in a movie

Gordon’s last name is Gecko

The movie won both an Oscar and a Razzie

It was directed by Oliver Stone

Gordon’s last name is Gecko

The name of the main character should be spelled Gekko, with two “k’s,” not a C. The filmmakers claim that insider trader Ivan Boesky’s 1986 speech at the University of California, in which he stated, “Greed is all right, by the way. I think greed is healthy. You can be greedy and still feel good about yourself,” served as the inspiration for the film’s catchphrase, “Greed is good.”

Open outcry

All bids are placed in the open market under the open outcry style of trading, which enables everyone to participate and fight for the best price. Although this system has a long history on the NYSE, private exchanges, brokerage transactions, and computer trading have mostly superseded it.

Charles Ponzi’s iconic early 20th-century scam, which will always be linked to fraudulent trading, was focused on what entity?

U.S. Postal Service

Ponzi set up a business called Securities Exchange Company and then guaranteed his investors returns of 50% in 45 days or 100% in 90 days from the money he was investing in postal reply coupons. He never truly made a profit to share with his investors; instead, what he was doing was taking the money that individuals had contributed and reinvesting it in other ventures.

19. What was the name of the regional stock market founded in 1864 to “benefit from the economic and investment boom caused by the Civil War” and to compete with the NYSE?

Open Board of Stock Brokers

The Stock and Trade Foundation

Central Trading Association

Securities and Exchange Commission

Open Board of Stock Brokers

At 16 and 18 Broad Street, the current location of the New York Stock Exchange Building, the Open Board of Stock Brokers had its offices. Because the OBSB used more advanced continuous trading systems rather than just twice daily trading, it quickly overtook the NYSE in terms of membership due to its usage of more current trading technologies. Both marketplaces were combined in 1869.kk]

What does the abbreviation LBO mean in the context of stock trading, which Malcolm McLean invented in the 1950s?

Liquidity Bid Opportunity

Leveraged Buyout

The term “leveraged buyout” refers to the acquisition of a business employing a sizable sum of borrowed funds to cover the acquisition costs. Most people agree that McLean Industries’ acquisition of the Pan-Atlantic Steamship Company in 1955 was the first leveraged buyout.

Sorry. You don’t know anything about the stock market.

Doing Great. You Know About Wall Street.

Brilliant. You are the master of Wall Street.

[giveaway id=12098]